Audit Assertions for Purchases

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Usually the control procedures of.

Auditing Cost Of Goods Sold Risks Assertions And Procedures Audithow

The result of reviewing and investigation will be reported to shareholders and other key internal stakeholders.

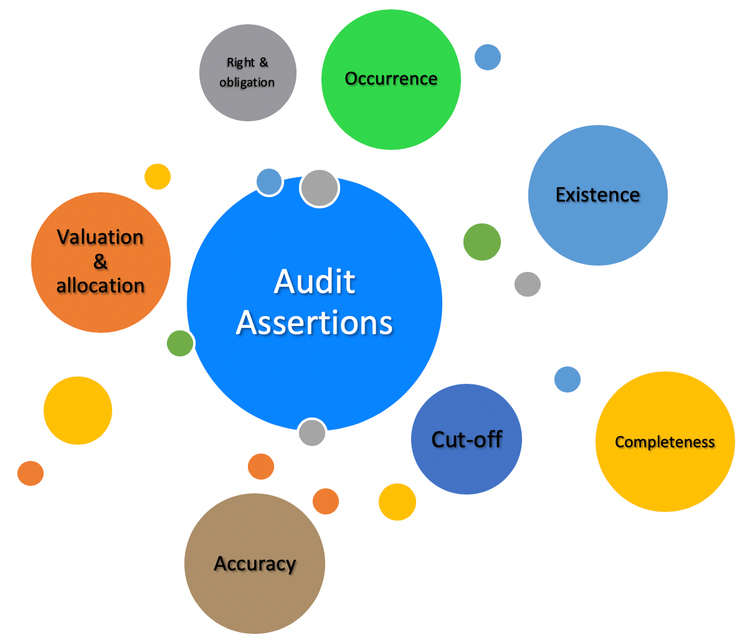

. Accounts Commission for Scotland. These are explained in detail below. Assertions about classes of transactions and events and related disclosures for the period under audit i Occurrence the transactions and events that have been recorded or disclosed have occurred and such transactions and events pertain to the entity.

Observing the distribution of paychecks. Whilst the procedures are perhaps similar in nature their purpose and relevance is to test different assertions regarding inventory balances. The following are the accounting records for both purchases on credit and cash purchases.

In this post Ill answer questions such as how should we test accounts payable. Board of Trustees of. The audit assertions for fixed assets are included in the table below.

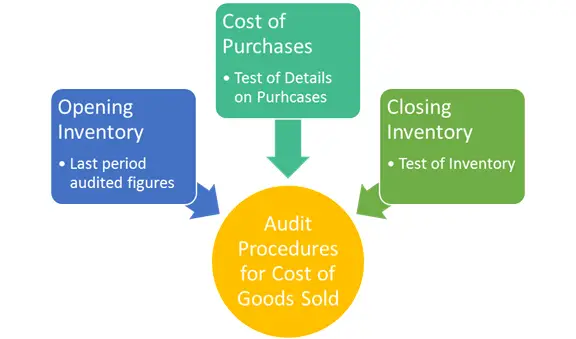

As auditors we usually audit inventory by testing the various audit assertions including existence completeness rights and obligations and valuation. Prepaid expenses are known as assets that are being paid for and then used gradually during the accounting period ie office suppliesA company purchases and pays for office supplies and as they are consumed they will become an expense. For an auditor to be reasonably assured of the Cash Disbursements made by the entity tests will be performed to cover the audit assertions.

8 Full PDFs related to this paper. Cash purchases have happened when an entity makes a purchase of goods or renders the services and then makes the payments by cash immediately. 1 The auditors consideration of illegal acts and responsibility for detecting misstatements resulting from illegal acts is defined in AS 2405 Illegal Acts by ClientsFor those illegal acts that are defined in that section as having a direct and material effect on the determination of financial statement.

Audit Evidence This section explains what constitutes audit evidence in an audit of financial statements and addresses the auditors responsibility to design and perform audit procedures to obtain sufficient appropriate audit evidence to be able to draw reasonable conclusions on which to base the auditors opinion. When the office supplies are utilized during the month an audit adjustment entry will be made to credit prepaid office. Other bodies and offices added on 5th March 2012.

These are compliance requirements that are subject to the compliance audit. This test can be performed by selecting purchases and sales of the items for the few days before and after the end of the accounting period to ensure that transactions related to items are recorded in the correct accounting period. The National Convener of Childrens Hearings Scotland.

Typically we perform the audit of accounts payable in conjunction with the audit of purchases. Read more the audit report The Audit Report An audit report is a document. The assertions listed in ISA 315 Revised 2019 are as follows.

Audit assertions for fixed assets. Information that the auditor must report as part of a prescribed audit. The internal controls for account payable are directly linked to the clients internal controls of the purchases.

For a detailed list of accounting audit definitions see PCAOB document AU 801. Sales purchases and account balances eg. See page 64 and Chapter 16 of the notes assertions relate to classes of transactions eg.

Inspecting investment securities on hand and comparing with previous year balances and accounts along with purchases and sales in the current. The audit is an art of systematic and independent review and investigation on a certain subject matter including financial statements management accounts management reports accounting records operational reports revenues reports expenses reports etc. This could be the result of intentional fraud or.

Substantive procedures are the method or audit tests designed by an auditor to evaluate the financial statements of the company which require an auditor to create conclusive evidence for verifying the completeness accuracy existence occurrence measurement and valuation audit assertions of the financial records of the business. Vouch new purchases and disposals of investments to supporting documents eg. The assertions applicable to Cash Disbursements are.

8 Audit Risk describes audit risk and its components in a financial statement audit the risk of material misstatement consisting of. One high risk of inventory is that the company bought the inventory but the purchases were not recorded into the inventory account. Confirms sales values and purchases costs ie.

These aspects of audit risk are sampling risk and nonsampling risk respectively. And should I perform fraud-related expense procedures. In the audit of investments we test the valuation assertion to ensure that the investment.

First its easy to increase net income by not recording period-end payables. People also downloaded these free PDFs. Audit assertions for Investments.

Investments are audited by testing various audit assertions as existence completeness valuation and rights and obligations. Audit and Assurance Class Notes. Audit assertions for accounts payable.

Thus in this section we will take some assertions that we usually test in. Accounts payable balances reported on the balance sheet include all payable transactions that have occurred during the accounting period. Put the relevant assertions next to each audit stepthis makes the connections between the RMMs at the assertion level and the audit steps clear.

Second many forms of theft occur in the accounts payable area. Other bodies added on 1st April 2015. Investments reported on the financial statements really exists at the reporting date.

Inspecting payroll tax returns. And retained earnings comes from the earnings or losses on the income statement. Accounts payable is usually one of the more important audit areas.

By inspecting the invoice. A short summary of this paper. Collectively all classes of transactions account balances and their related disclosures make up the financial statements.

Footing and crossfooting the payroll register. Get 247 customer support help when you place a homework help service order with us. Most of the business prefer to make the payments by banks transactions to minimize the fraud case.

Footnotes AS 2401 - Consideration of Fraud in a Financial Statement Audit. In order to audit the accounts payable it requires to use the combination of analytical procedures and tests of detail or substantive audit procedures for accounts payable. If we disregard stock purchases and sales equity is usually the accumulation of retained earnings.

This includes details collected during an audit that allow an. When control risk is assessed as low for assertions related to payroll substantive tests of payroll balances most likely would be limited to applying substantive analytical procedures and A. Full PDF Package Download Full PDF Package.

People also downloaded these PDFs. Audit assertions for investments. Auditors have limited time to conduct the audit and they need to submit An audit report is a document prepared by an external auditor at the end of the auditing process that consolidates all of his findings and observations about a companys financial statements.

The audit risk for Cash Disbursements is generally low but it also heavily depends on how well the entitys internal control policy is. An integration joint board established by order.

Audit Expenses Meaning Audit Assertions Risks Substantive Procedures Carunway

Understanding Audit Assertions A Small Business Guide

Audit Procedures Types Assertions Accountinguide

Audit Expenses Assertions Risks And Procedures Wikiaccounting

Comments

Post a Comment